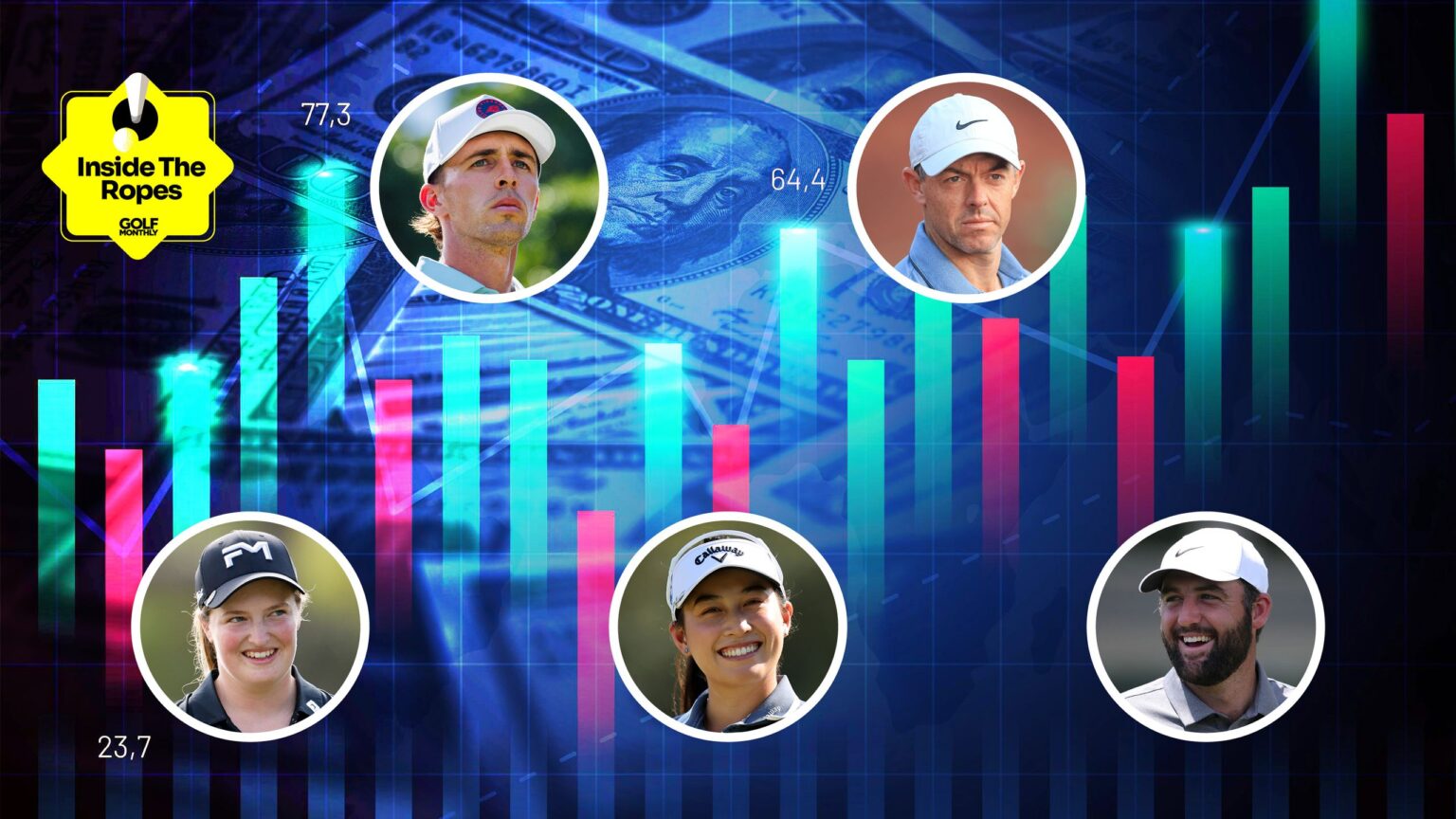

Investing in Golf: Top Prospects for 2026 and Beyond

As the world of professional golf continues to evolve, savvy investors are on the lookout for opportunities that could yield substantial returns. From established blue-chip players to emerging talents poised for breakout performances, the landscape is ripe for strategic investments. Below is an overview of potential investment opportunities within the professional golf sector, focusing on golfers and related entities poised for growth by 2026.

Blue-Chip Players: Stability and Consistency

These seasoned professionals have consistently delivered exceptional performances, making them reliable options for investors.

Key Characteristics:

- Track Record: Proven success in major tournaments.

- Marketability: Strong brand presence and endorsements.

- Longevity: Experience in navigating the competitive sports landscape.

Notable Blue-Chip Players:

- Player A – With multiple major championships to their name, Player A remains a favorite in the betting markets.

- Player B – A consistent top performer, Player B’s endorsement deals continue to grow, enhancing their marketability.

Emerging Talents: The Start-Ups of Golf

While blue-chip players offer stability, emerging talents present exciting investment opportunities for higher returns.

Key Characteristics:

- Potential for Growth: Young athletes showing promise, often with lower initial investments.

- Social Media Savvy: Their ability to connect with fans online can significantly boost their market value.

- Innovative Playing Style: Fresh techniques and approaches to the game can attract attention from sponsors.

Notable Emerging Players:

- Player C – Recently captured attention with impressive finishes in major tournaments.

- Player D – A rising star in the junior circuit, Player D is generating buzz as a next-generation talent.

Investment Strategies: Targeting Golf’s Future

Investing in professional golf can take various forms. Below are strategies to consider:

1. Direct Athlete Investment

- Invest in shares or equity of professional golfers, particularly those with endorsement deals.

2. Sponsorship Opportunities

- Align with emerging talents for sponsorship deals that can yield returns as their careers progress.

3. Media and Merchandise Engagement

- Consider investments in companies producing golf-related content and merchandise, tapping into the growing popularity of golf.

Conclusion: The Future of Golf Investment

With the golf landscape continuously changing, identifying both blue-chip players and emerging talents creates an array of investment avenues. As we approach 2026, investors should remain vigilant for potential low-cost startups within this dynamic space. By diversifying portfolios with a mix of established stars and promising newcomers, savvy investors could harvest significant returns in the years ahead.

For more insights on the evolving world of professional golf investments, stay tuned for ongoing analysis and expert opinions.